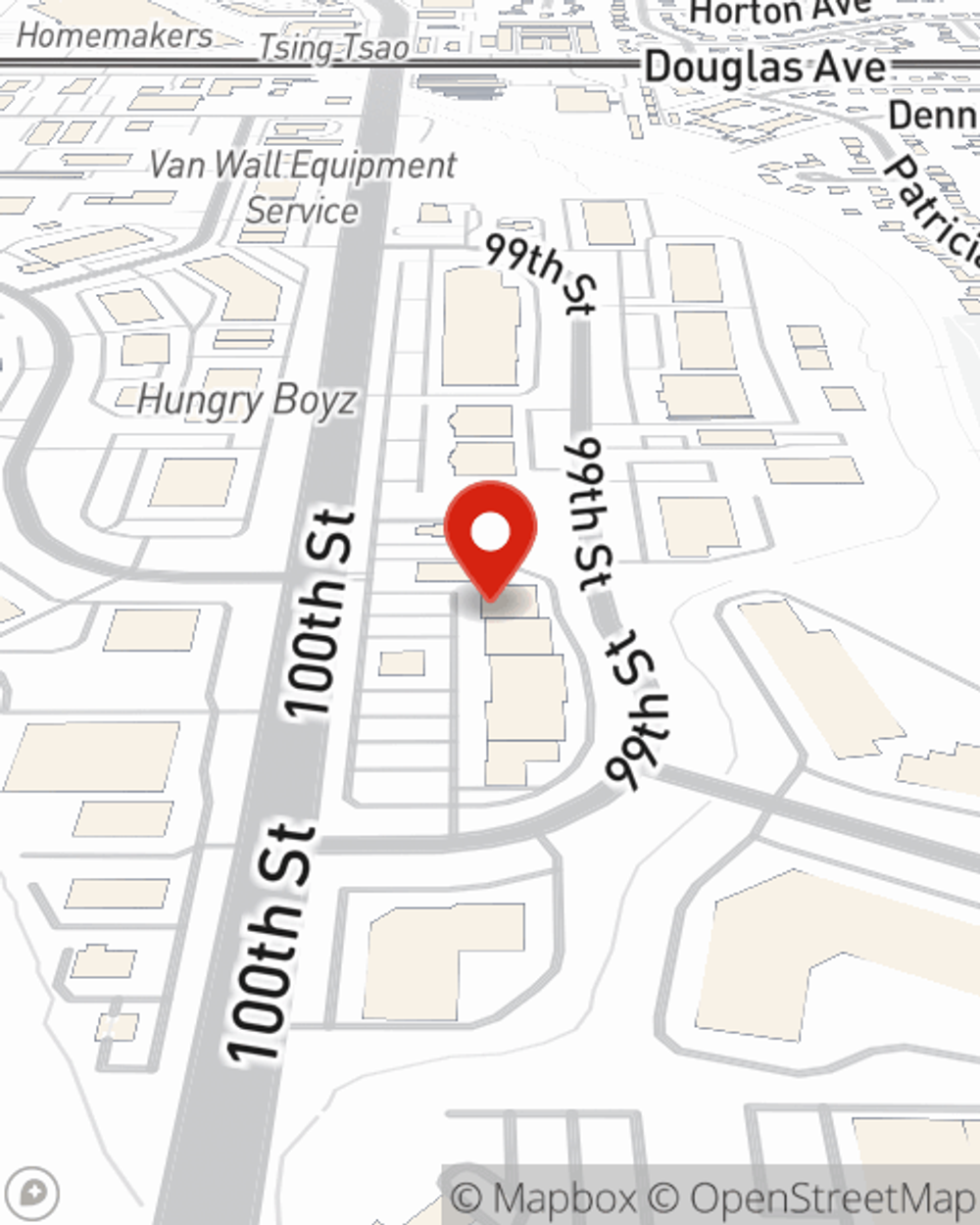

Business Insurance in and around Urbandale

Looking for protection for your business? Look no further than State Farm agent James Walford!

Cover all the bases for your small business

- Polk County

- Dallas County

- Urbandale, Iowa

- Johnston, Iowa

- Clive, Iowa

- Des Moines, Iowa

- West Des Moines

- Grimes, Iowa

- Waukee, Iowa

Cost Effective Insurance For Your Business.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent James Walford. James Walford gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for protection for your business? Look no further than State Farm agent James Walford!

Cover all the bases for your small business

Protect Your Business With State Farm

For your small business, whether it's a beauty salon, an acting school, a meat or seafood market, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, accounts receivable, and equipment breakdown.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Call or email State Farm agent James Walford's team today to get started.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

James Walford

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.